Purpose

The UK Government announced in 2017 its intention to Making tax digital (MTD), and in 2018 HMRC provided guidance on what this meant to businesses.

The first stage of the MTD process will be VAT, and all businesses with a turnover of above £85,000 will be required to use a compatible software

package to file VAT Returns from April 2019.

After looking at the current accounting software market Concept2Engineering noticed the market was driven by subscription based software requiring

changes to organisational processes, which we found undesirable. Therefore we decided to create a custom piece of software which was compatible with

HMRC’s requirement for our internal use that allowed us to continue using our spreadsheet based acounting system. Since then, we have decided to sell

copies of this program by means of a one off payment – allowing other companies, or accounting agents, the freedom from subscription fees and the inevitable price hikes after

6-12 months once staff are familiar with the product and data is stored within the package.

Key Features

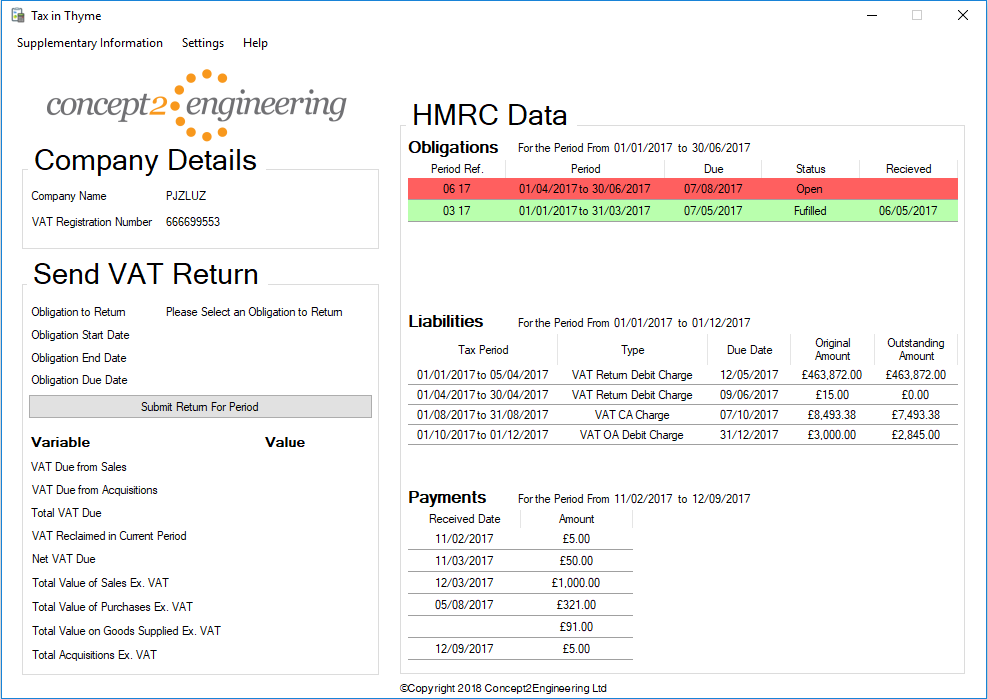

- Simple, clear and easy to use interface

- Designed to allow for continued use of established spreadsheet based accounting, rather than being forced to migrate this data to a new program

- Works with popular spreadsheet programs such as Microsoft Excel and Apache OpenOffice Calc, with file extensions such as '.xls','.xlsx','.xlsm', and '.ods'

- Contains settings to allow for use by accounting agents with multiple clients or individual companies

- One time payment of £40 for a lifetime licence - no subscription fee

- Recognised for use by HMRC

The VAT Return Process - Quick Guide

Here is the few easy steps required to submit your return with Tax in Thyme:

- Copy the template worksheet provided into your accounts workbook

- Name the worksheet as the Obligation Period Ref shown on the Tax in Thyme user interface

- Ensure the 9 values on the template worksheet are linked to your VAT calculations and show the correct monetary values

- Start Tax in Thyme software and select an Obligation to be returned

- Click the “Submit Return For Period” button and select your accounts workbook from the pop up window.

- Confirm details now shown in user interface are correct

- Accept legal declaration and sign in to HMRC using your government gateway credentials

- Your Return has now been filed successfully with HMRC and the receipt has been saved in your accounts workbook!

What it does

Following the user's authentication with HMRC, the program retrieves the users VAT obligations, liabilities and payments from the secure HMRC database and displays this information in the user interface. The user can then set up their existing accounts spreadsheet to have the required VAT calculations read by our program by using 'Named Ranges.' These are easy to set up, require no formatting or calculation changes to the document, and their set up is explained in our manual. Alternatively, the user can copy our worksheet template which contains cells allowing for the input of the values required for the VAT return. After the spreadsheet has been linked to the program, Tax in Thyme will then upload the relevant values from the spreadsheet to HMRC. Finally, the program inputs the processing details received from HMRC, such as the Submission Unique reference number, into the spreadsheet from which the data was taken. This is then saved for the user’s records.

Data Protection

Tax in Thyme does not require Cloud computing; it is designed to be fully localised to your system. Unlike certain other pieces of bridging software, you do not need to digitally store your accounts within the package, and your data is not stored online (except by HMRC). As such, this allows for a subscription free model and lets companies handle their data, without worrying about a third party accessing it. This also means we do not collect any of your data used in Tax in Thyme.

Support

Purchase of this software includes any updates that may be required by HMRC. We also offer support on any issues you have while using the software and provide a comprehensive user manual.

We would like to clarify that we use this software ourselves, which guarantees that any updates would be made within a timely fashion, as we also need the software to fulfil our own

obligations to HMRC.

Pricing

A one-time payment of £40 entitles the user to a lifetime licence for use with a single company's VAT registration number. This also includes a manual, software updates and user support.

Pricing for agents who deal with a number of companies can be offered on request.

Disclaimers

Click here to view our Terms and Conditions

Click here to view our Privacy Policy

If you have any interest in this product please contact us by email or telephone to discuss payment methods and the software's distribution.